Exclusive $40 Sign Up Bonus

KOHO Referral Code : KOHOBONUS40

Terms: To get the bonus. You must sign up with code or referral link and make first purchase over $20 with 30 days of account creation. See below for more details

About KOHO Financial

KOHO is a Canadian financial technology (fintech) company that provides a spending and savings account with an integrated app to help users manage their finances. It is not a traditional bank but partners with regulated financial institutions to offer services like a no-fee spending and savings account, cash back rewards, a line of credit, and a credit-building program. KOHO is available exclusively in Canada and operates on a prepaid Mastercard that is accepted worldwide.

KOHO Joint Accounts

With KOHO Joint Accounts, you have the option to share an account with anyone you choose, such as a sibling, spouse, roommate, or friend.

Each of you will receive a card, allowing for easy sharing of funds, tracking of expenses, and the establishment of shared savings goals.

After registering for a card, you can proceed to create a joint account within the app and invite your others.

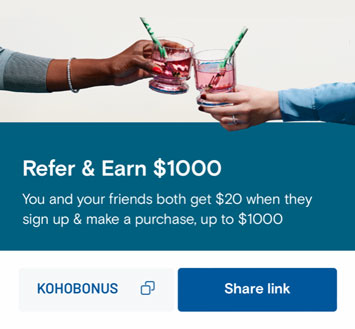

KOHO Referral Program

You will get an exclusive referral bonus of $40 just for signing up and making a transaction over $20 within the first 30 days of using the KOHO referral code “KOHOBONUS40“.

Note that the time to make a purchase begins immediately upon signing up, rather than when you receive the card. So best to make your first purchase as soon as possible.

You can use our exclusive KOHO referral code “KOHOBONUS40” to sign up and take advantage of this great bonus offer.

Refer your Friends and Family

The bonuses don’t end there. Tell your friends and family about KOHO and share your referral code with others. Let them know how great the card is and spread the word! Earn up to $1,000 with KOHO

To find your unique promo code. Log in to the KOHO mobile app, where you will see a small box on the top right. Your code will be displayed on this screen. For every person you refer, both yourself and your friend will get a bonus.

Virtual Card

KOHO also provides you with a virtual card. As soon as you are signed up you can load and start using your new digital KOHO card right away while you wait for the physical card to be sent.

The virtual card can be used just like a regular physical card, however basically only for online or over the phone purchases. Or, you can add the virtual card to Apple Pay or Google Pay and use it pretty much anywhere.

For example, sign up, load some money onto your brand new account, and start shopping at your favorite online stores. No need to wait. Nice and easy!

Premium Account

KOHO has also introduced a premium service for $9 a month (or $84 a year). Offering 2% Cash Back on Transportation, Groceries and Restaurants. No Foreign Exchange (FX) Fees. (Great if you are a traveler!) Access to Financial Coaching, 1 Free International ATM Withdrawal per Month, Price Matching, and more.

You can try it out for free for 30 Days. Also, once you pass your free trial, you can order your new KOHO Premium Card. A new vertical design card!

KOHO Credit Building

Need to build your credit? KOHO offers a subscription based credit building service. They will report your progress to a major credit bureau and help you grow your credit score. All with very little effort on your part. All you need to do is make sure your balance has enough to pay the $7 monthly subscription and then just sit back and they will take care of the rest. You can view your score monthly in the app and the progress.

KOHO Cover

What is KOHO Cover? Cover is a subscription-based, overdraft protection that gives you access to extra funds when you need it. Cover can give you peace of mind knowing that you can tap into additional money without the worry of accumulating overdraft interest.

Cover does have a subscription charge of $5 a month. For that subscription they also give you access to a financial coach for money related questions. And there are no late fees or interest.

KOHO Benefits and Features

- No annual fees

- Exclusive $40 bonus with KOHOBONUS40 referral code

- 0.5% cash-back on all purchases and up to 10% at partners

- Earn high interest on your entire balance

- Free Interac e-Transfers

- Automated savings goals

- Round up each purchase to the nearest $1, $2, $5, or $10

- Real-time spending insights

- Exclusive Offers

- Joint Accounts

- Bill Pay

- Apple Pay Compatible

- Google Pay Compatible

- Additional Premium Features like KOHO Cover and Credit Building

Are There Other Comparable Prepaid Cards?

Yes. There are other cards with similar features.

For example. NEO Money or Wealthsimple Cash. Both offer very similar benefits. And both offer great sign up referral bonuses to get started.

Here are some of our reviews of these cards with details:

NEO Money with a $25 Bonus

Wealthsimple with a $25 Bonus

Getting Started With KOHO

- Install the Mobile App. You can search the mobile store or click the link below

- Enter the referral code: KOHOBONUS40 (If you clicked the link it will be auto populated)

- Once signed up you can add your virtual card to you phone or wait for your physical card to arrive

- Load funds onto your card

- Start shopping!

- You will receive your bonus shortly after completing a purchase over $20

Frequently Asked Questions

Is KOHO a credit card?

No. KOHO is a prepaid card. You must fund your account first. Then you can use your card to make purchases from your balance. It is very much like a debit card with the benefits of a credit card. Like cash back.

Are my funds CDIC insured?

KOHO itself is not CDIC insured. However, All cash balances from your accounts earning interest are held in trust at Peoples Trust Company. A Canada Deposit Insurance Corporation (CDIC) member institution. Your balances are insured up to $100,000.

How do I use a KOHO referral code?

You must use the code when you sign up. You can use one of the sign up links on this page. Or use the KOHO referral code "KOHOBONUS" on the sign up page. This code will be whatever the current promotion is. Currently it is a $20 bonus.

Is KOHO available in Quebec?

Yes, KOHO is available to residents of Quebec. They even have dedicated french support. Reach out to them in the app or phone if you need any support.

Do I earn interest on my balance?

Yes. You will earn interest on your entire balance. These rates are competitive. You can refer to the KOHO webpage or the KOHO app to view the current interest rate.

How do I add money to my account?

There are three ways to add money to your balance: E-Transfer, VISA Debit, or Direct Deposit. Make sure your name matches on your e-transfer or direct deposit account. KOHO does not accept wire transfers.

Can a minor sign up for KOHO?

No. You must be the age of majority in your province to sign up for KOHO.

Does KOHO affect my credit score?

No. KOHO does not affect your credit score. They will only do a soft check to verify your identity. However, they do offer a credit building service to help you build credit if you are interested in that.